Techno-Economic Analysis for Economic and Market Impact

DuraMAT integrates solar techno-economic analysis (TEA) to identify photovoltaic (PV) module research areas that could have the greatest economic and market impact.

We develop customized lifecycle economics and finance models for PV products and systems that can be applied to a variety of research topics. From detailed, bottom-up manufacturing cost models to complete project life cycle levelized-cost-of-energy and internal rate of return computations, we're able leverage industry-relevant TEA analysis and network capabilities.

TEA work products can provide relevant and credible insights that can be used for:

- Decision-making

- Proposals

- Inclusion within publications.

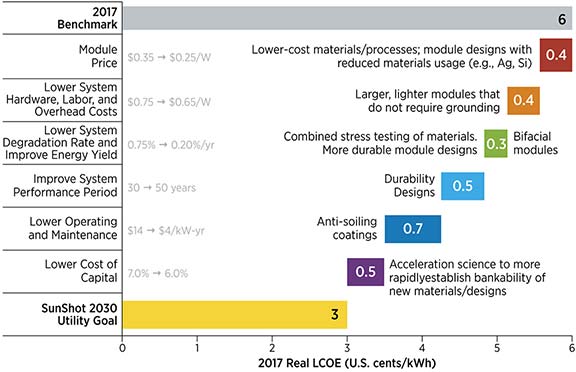

Specific to DuraMat, we use TEA to quantify the costs and performance metrics for new products and practices that keep the value proposition to levelized cost of energy and internal rate of return overall net positive. TEA can also be used to identify cost-reduction pathways and appropriate and meaningful research project milestones and to uncover partnering opportunities between researchers and industry players.

Additionally, we quantify the impacts of PV module materials substitution or reduction, the impacts of lower operations and maintenance events and associated expenses, and the value proposition of new products that might offer improved energy yield and system reliability.

Core Objective

Location

National Renewable Energy Laboratory

References

Woodhouse, M.; Fu, R.; Horowitz, K.; Margolis, R. (2016). On the Path to SunShot: The Role of Advancements in Solar Photovoltaic Efficiency, Reliability, and Costs.

Woodhouse, M.; Fu, R.; Remo, T.; Walker, A.; Jordan, D.; Kurtz, S. (To be published). On the Role of Reliability and Durability in Photovoltaic System Economics.

U.S. Department of Energy. (2017). SunShot 2030 Progress and Goals Analysis. Accessed: June 14, 2018.

Jones-Albertus, R.; Feldman, D.; Fu, R.; Horowitz, K.; Woodhouse, M. (2016). “Technology Advances Needed for Photovoltaics To Achieve Widespread Grid Price Parity.” Progress in Photovoltaics. 24(9), 1272–1283.

Learn More

Webinars:

Adding Climate Effects to the Online LCOE Calculator in DataHub, presented by Brittany Smith, NREL.

A Pathway To Reduce Operations and Maintenance Expenses by Mitigating Cracked Solar Cells and Hot Spot Formation, presented by Sang Han, Osazda and University of New Mexico; Mike Woodhouse, NREL.

On the Costs and Benefits of Combined Accelerated Stress Testing (C-AST) for PV Project Economics, presented by Mike Woodhouse & Peter Hacke, NREL; Tristan Erion-Lorico, PVEL.

The Role of Reliability and Durability in Photovoltaic System Economics, presented by Michael Woodhouse, NREL.

Contact

To learn more about this capability area, contact Michael Woodhouse.